Buying Shares in 2023

Which? Recommended Investment Platform Provider 2023

Which? Recommended Investment Platform Provider 2023

- Huge Investment Choice

- Invest from £25 pm

- Buy UK, US & International Shares

Looking to invest in the Stock Market?

Are you looking to buy shares such as Lloyds, Unilever or Shell? Or would you prefer to invest in international shares such as Netflix, Tesla or Apple?

We have reviewed some of the best UK share trading platforms and apps to help you make the right choice.

Top trading apps

-

Flat Fee Trading

- Join today & get £50 FREE trading credit

-

Great Prices

- Barclays Price Improver™

-

Active Traders

- Trade 18000+ Markets

-

Trading Tools

- Experienced Investors

The right share trading app or platform for you will depend on your requirements.

How do you buy shares using a trading app

Our view: The next generation of online trading platform apps means you can get setup & buy UK shares in as little as 5 minutes!

- Select a share trading app - See our top platform picks

- Open your share account - To do this you will need your bank details and national insurance number

- Fund your account - You will need to fund your a/c with a debit or credit card or bank transfer

- Search for the share using the UK stock code - Type in the stock code into the search box

- Check out the latest info and price for the selected share - Some platforms offer free research and analysis

- Buy the share - Nice and easy!

| Invest in real stocks with 0% commission*. Over 5300 instruments… Features: XTB is one of the largest stock exchange-listed FX brokers in the world with 720,000+ customers and over 20 years of activity in the financial markets. Capital at Risk | Go to website » | |

| World class trading platform: Easy to use, fully customisable, superior execution speeds, performance statistics. Applying for an account is quick and easy with a secure online form, and you could be trading within minutes. Wide range of instruments -forex, indices, commodities, shares and ETF’s. Multilingual customer support team is ready to help you - 24h hours a day from Monday to Friday. *For monthly turnover up to 100,000 EUR (then comm. 0.2%, min. 10 EUR). Capital at risk | ||

| Join today & get £50 FREE trading credit (T&Cs apply). More than 40,000 UK & international investment options Invest from £1 Features: Flat fee plan starts from £4.99 pm No trading fees when you top up monthly with the ii regular investing service. | Go to website » | |

| Trusted by over 400,000 people. Fully FSCS protected. ADVFN Winner 2022 "Best Low Cost Stockbroker". Capital at risk. | ||

| Choose from over 2,000 funds From £25 per month Features: Low cost ISA. Multi-award winning ISA provider. | Go to website » | |

| Mobile app - manage your portfolio on the move. FSCS protected. Capital at risk. | ||

| Buy & trade over 3500+ UK, EU and US stocks with low 0.35% currency conversion. Features: Say goodbye to high minimums and barriers to entry. Capital at Risk | Go to website » | |

| Multi-currency investing, your money goes even further without the constant foreign exchange fees. Deposit, hold and invest in international stock markets in EUR, GBP and USD — all under one roof. Shares have a low, transparent execution cost. Investing in your local ETFs is completely free of Lightyear fee (other fees may apply). Earn interest on uninvested cash. Access live news feeds about the stocks you own, as well as professional analyst ratings & price targets. Lightyear is now live on web and has launched earnings calls audios. Capital at Risk | ||

| Trade UK & US shares from £6. International shares from £9. Features: Flat fee plan starts from £4 pm 8,000+ investments to choose from. | Go to website » | |

| Smart Investor gives you the investment choice and research tools you need to grow your money. Over 300,000 people have used our award winning accounts, expert insights and resources to help work towards their financial goals. Capital at risk. | ||

| Access over 3,000 funds. UK & Overseas shares. Invest from £100 or £25 pm Features: Live share prices. Award winning services. | Go to website » | |

| Hargreaves Lansdown is the UK's No 1 platform for private investors trusted by over 1.6 million customers. Capital at risk. | ||

| Access to 70,000+ instruments, smart trading tools & market insights Investment platform for different needs and experience levels | Go to website » | |

| Saxo serve clients in 170 countries, hold 70+ bn GBP in assets under management & process 1m transactions daily. FCA regulated. Capital at risk. | ||

| Buy & trade over 17,000+ shares online. Zero commission on US shares. FX conversion fee of just 0.5%. Invest from £1 Features: Easy to use platform. Demo account. Speak to other traders. Award winning trading app. | Go to website » | |

| IG offer exclusive out of hours giving access to 70+ shares when the market is closed. 313,000+ clients worldwide. FCA Regulated. Capital at risk. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider | ||

| Choice of 500 low cost ETF Funds Invest from £1 Features: No buying or selling fees. No ISA account charges. Powerful automation. Easy diversification. DIY or managed. | Go to website » | |

| The InvestEngine offers investors a low cost ETF investment platform. Build your own portfolio commission free or leave it to their experts for just 0.25%. Build your own low cost portfolio using managers such as Vanguard, iShares & Invesco. FSCS protected. Capital at risk. | ||

Why use a trading platform app to buy UK shares?

You don’t have to buy and sell UK shares using a shares app to manage your investments.

You could go down the old school route using a stockbroker directly to buy and sell investments.

This can involve lots of paperwork and waiting for the postman to send you paper statements which for some people may be perfectly adequate.

Your preference may be to deal with a real person to make things happen – whilst this can work it can be slow and cumbersome and potentially more expensive.

The good news is that with advances in technology, investors now have significant choice when buying UK and international shares.

Benefits of using a trading platform app include:

- Lower trading costs

- Easy access to the UK and international stockmarkets

- 24/7 access to your investments

- You can hold all your tax efficient investments such as ISAs and SIPPs in one place: including lifetime ISAs, right to buy ISAs and junior ISAs

- Plus any other fund holdings or shares that you’re trading outside of a tax-free environment, from a general trading account

How do you pick a share trading platform/ app?

Trading platform services offered vary widely, and so do the costs.

5 things to consider:

1. Do you want to trade UK shares?

Not all investment platforms allow you to trade shares on all markets.

If your focus is on UK shares, there is an extensive choice of options.

If you want to invest further afield, then you need to ensure the platform you choose is right for you.

2. Do you want to do a lot of trading?

Active investors will want to look for a trading app that offers the lowest fees for volume trades.

If you are going to trade stocks and shares regularly, most trading platforms will offer lower trading prices based on volume.

3. Not all trading platforms offer mobile trading apps.

Before you sign up with a platform, check if they offer a trading app:

Interactive Investor Platform & App »

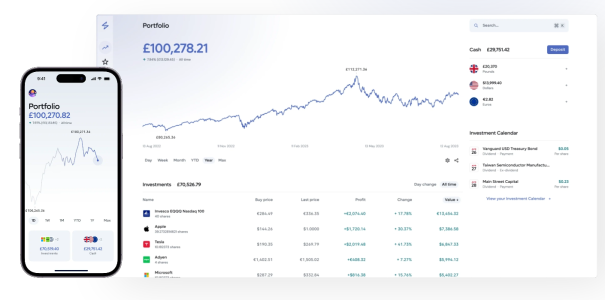

ii’s platform/app with face recognition or fingerprint tech access allows you to:

- Buy & sell shares, add cash and view accounts with an easy-to-use interface

- Access over 40,000 shares, ETFs, funds and more

- Send secure messages & enjoy speed, security & simplicity to allow you to trade while you are on the move

IG Share Trading Platform & App »

Trade shares wherever you are – IG trading platform & app features include:

- Buy & sell shares, add cash and view accounts with an easy-to-use interface

- Access over 40,000 shares, ETFs, funds and more

- Send secure messages & enjoy speed, security & simplicity to allow you to trade while you are on the move

SaxoTraderGO Platform & App »

Saxo offers a range of trading platforms that fit your needs & experience. Features include:

- Award-winning trading platform/apps

- In-depth research tools

- Interactive risk management features

Hargreaves Lansdown Share Trading Platform & App »

With 1.7 million clients and £120bn under administration HL is worth a closer look if you are looking for a simple trading platform.

- UK’s No. 1 investment platform for private investors

- Trade UK shares, bonds and funds, and overseas shares from Europe, the US and Canada.

- Keep track of your investments, so you always know how they’re performing

Lightyear Mobile Trading App »

- Great for US trading – 3000+ US Stocks across NYSE & Nasdaq

- Your money is always working – Earn up to 4.5% on your cash

- 4.8/5 rated on trustpilot

4. How easy is this trading platform & app to use & what kind of features does it offer?

How easy is the platform/app to use to buy and sell UK shares?

App platform functionality is becoming the key battleground in persuading traders which platform to select.

Trading on the move is key in offering traders alerts and buy/sell signals at key trading times. A good app trading app will offer the full range of ‘at best’, ‘stop loss’ or ‘limit’ orders.

Good research tools and the latest news feeds to help decision-making are high on traders’ wish lists when selecting a good trading platform.

Many investors are prepared to pay a bit more in fees for platforms that offer an easy interface that makes for a great trading experience.

IMPORTANT:

No news, feature article or comment should be seen as a personal recommendation to invest. Before deciding to invest, you should ensure that you are familiar with the risks associated with a particular plan. If you are unsure of the suitability of a specific product, both in respect of its objectives and risk profile, you should seek independent financial advice.

The value of shares, ETFs and ETCs bought through a share dealing account, stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 67%-81% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

Tax treatment of ISAs depends on your individual circumstances and is based on current law which may be subject to change in the future. ISA transfer charges may apply, please check with your provider.