Best Low Cost Investment Platforms 2020

How do you choose an investment platform?

The services offered by the different types of platforms vary widely, and so do the costs.

This isn’t a chop-and-change decision that you’ll revisit every year or so it is important to select the right platform provider for you.

Choosing the right platform will depend on your investment objectives and how much you are looking to invest.

What is the best investment platform to choose from?

Today’s investor in 2020 has a lot of options to choose from.

One of the key considerations is cost. However picking the cheapest investment platform is not as simple as it sounds, as each platform provider has its own costing model which often makes it difficult to compare like for like.

Below we have outlined what can expect to pay in charges for 4 of the UK’s largest most popular investment platforms based on investing in a low cost tracker fund (iShares Core FTSE 100 UCITS ETF).

| Investment Platform | Annual Platform Fee | iShares OCF Fund Charge |

Annual Charge on £10,000 |

Annual Charge on £20,000 |

Annual Charge on £40,000 |

Annual Charge on £100,000 |

Annual Charge on £250,000 |

|---|---|---|---|---|---|---|---|

| Interactive Investor | £9.99 pm flat fee | 0.7% | £126.88 | £133.88 | £154.88 | £189.88 | £294.88 |

| Hargreaves Lansdown | 0.45% up to £249,999, reducing to 0.25% from £250,000 to £1m, reducing to 0.10% from £1m to £2m. No fee for assets over £2m |

0.7% | £52 | £104 | £208 | £520 | £1,300 |

| AJ Bell | 0.25% on first £250K | 0.7% | £32 | £64 | £128 | £320 | £800 |

| Fidelity | 0.35% from £7,500 to £249,999, reducing to 0.2% from £250,000 to £1m. No fee for assets over £1m |

0.7% | £42 | £84 | £164 | £420 | £675 |

As you can see the right platform for you will depend on how much you are investing.

Other considerations include:

- How easy is the platform to use and what tools and research is on offer

- What fund discounts are there? different platforms have negotiated different discounts on funds

- Customer reviews – useful in understanding strengths and weaknesses of platform providers

- Level of customer service provided

Top 10 criteria you’ll want to consider:

1. Do you already have an idea of the investments you want to invest in?

If you are looking to trade shares only then a platform that offers low cost dealing fees may be a priority. A number of platforms offer advanced research trading tools to entice you to them.

Or you may want buy foreign shares (not all platforms cater to this) or trade in ETFs (exchange-traded funds – usually tracking an index).

If you are more interested in collective funds then this again may determine who you go with. Charging structured for funds held on the platform will vary. Over time the impact of such charges can be significant.

2. Do you want to manage your own investments, or have someone else do it for you?

Your answer to this will depend on:

- How confident are you about investing?

- Will you enjoy getting underneath the bonnet?

- Do you have enough time to be an active manager?

- Would you mistrust someone else making these decisions on your behalf – or have more confidence in their market knowledge than your own?

You can choose from:

Do it with me platforms and Do it for me platforms

Many platforms offer both. Catering for first time investors through suggested fund options or strategies through to experienced investors where the focus is on providing advanced tools to allow independent decisions.

You get a range of active investment management, from advice and assistance to completely hands-free:

Platforms that do both:

See below 4 of the largest platforms in the market:

Important information: The value of investments can go down as well as up so you may get back less than you invested. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Tax treatment depends on individual circumstances and all tax rules may change in the future.

There are no tables for this criteria

Important information: The value of investments can go down as well as up so you may get back less than you invested. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Tax treatment depends on individual circumstances and all tax rules may change in the future.

Important information: The value of investments can go down as well as up so you may get back less than you invested. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Tax treatment depends on individual circumstances and all tax rules may change in the future.

Do it for me platforms

With do it for me platforms you get an expert to do the investing for you – typically you choose how cautious or adventurous you want to be and the timescales you want to work to:

DI

DIY investment platforms

3. Do you want to invest just in funds, or shares and funds?

Check what’s on offer, if you want to have the flexibility: some platforms don’t offer both.

4. Do you want your platform to be independent or fund-owning?

Do you want to be able to invest in independent funds, or are you happy investing via a fund manager such as Legal & General that offers just its own funds?

5. Do you have a self-invested pension?

You may want to look for a platform that can manage your self invested personal pension or SIPP as well: not all of them can.

6. Do you want to do a lot of trading?

Active investors will want to look for a platform that offers the best research, and the lowest fees for volume trades in funds, and stocks and shares.

7. How easy to use is this platform: what kind of tools and customer service does it offer?

These are often the criteria that count most highly with users, so do some research and read the reviews.

- Many investors are prepared to pay a bit more in fees for a platform that offers really useful apps and services.

8. How much are you investing?

You will want to look at the fee structures, and the thresholds for reduced fee charges.

- Platforms that charge flat-rate fees work better for large investors with £50K or more in their portfolios.

9. How has this platform performed?

This is a key consideration if you’re looking at having your investment managed by the platform, rather than going DIY.

You’ll want to look at the kind of returns that its investors have been getting: read the reviews and compare the results of the platforms you’re considering.

10. And finally… how much will it cost?

If you’ve worked through the other decision criteria first, you’ll understand that you shouldn’t choose solely on cost.

Some of the more expensive platforms are highly rated by their clients for usability and client support, or show consistently good returns.

Hargreaves Lansdown, Fidelity, AJ Bell for example, charge tiered account management fees which are higher than others, but they’re rated highly by investors for ease of use and good customer support.

- Choosing active management of your investments isn’t always cheaper than DIY: there are some price advantages to trading in scale.

- There has been a push to get platforms away from commission-based charges towards “clean pricing” annual fees.

- You need to be looking at annual administration charges, dealing fees, and any other costs, including exit charges.

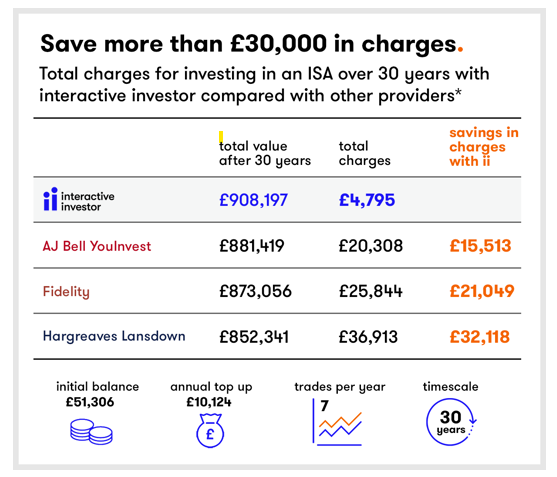

In independent research carried carried out by Lang Cat the impact of flat fees was looked at compared to providers who charge based on % value of portfolio. The survey was based over 30 years in an ISA account where the investments were split 50/50 between shares and funds and where there was a 5% annual return on the portfolio.

Undecided on your options?

When it comes to making investment decisions using the services of a qualified independent investment adviser may be worth considering.

Most IFAs will offer a free no obligation initial discussion. A good adviser based on what you are looking to achieve will put together a plan for your situation. Part of this plan may be helping you to decide what investment platform is suited to your situation.

We have partnered with an organisation Unbiased UK who will help you find a qualified adviser in your area. Find an investment adviser »

If you’ve decided to switch platforms…

DON’T withdraw your money from your ISA, and then pay it into your new account. It all has to stay quarantined within an ISA “wrapper” to hold onto the tax advantages.

- Instruct the platform you’ve chosen to move your funds over for you. (Get them working for their fees from Day One…) That way you’ll preserve their tax-free status.

No news, feature article or comment should be seen as a personal recommendation to invest. Prior to making any decision to invest, you should ensure that you are familiar with the risks associated with a particular plan. If you are at all unsure of the suitability of a particular product, both in respect of its objectives and its risk profile, you should seek independent financial advice.

Tax treatment of ISAs depends on your individual circumstances and is based on current law which may be subject to change in the future. ISA transfer charges may apply, please check with your provider.

Tags